You may have seen there has been a lot of talk on the internet about Chase Bank’s UK cashback debit card. We joined the waitlist pretty early before it launched. At the time of writing this review, we had used the card for a few months. Spoiler Alert: We really like this account. However, it’s not ready to replace your main current account just yet. Read on in this review of Chase Bank to find out why.

What is Chase Bank?

Chase is one of America’s largest banks. You may have seen their branches all across the US or even in movies or TV shows. Now they have launched in the UK as a digital only bank with their Cashback debit card and their high interest savings account

Key Features of Chase Bank Account

Let’s dive into what Chase has to offer and why you should consider using them as your bank.

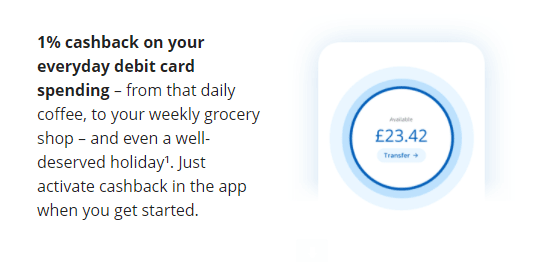

1% Cashback on all purchases

Chase is offering a whopping 1% cashback on your day-to-day spending when you use their card. All you have to do is sign up and activate the cashback offer in the app. This means you will get 1% cashback for an entire year. There are some exclusions to this, such as Antique shops, Car/Van dealers, crypto, gambling and debt payments to name a few.

5% Interest on Round ups

Chase has the option to round up every transaction you do to the nearest £1 and pop the difference into a savings account, although this concept is nothing new with other banks like Monzo, Starling and Halifax, also offering similar features. Where Chase takes this up, a level is by offering 5% AER (4.89% gross) variable interest boost, paid monthly.

Chase Saver account

Bank with Chase and you can open a savings account too. Start saving as little as you like, and as much as £250,000. You’ll earn 1.5% AER (1.49% gross) variable interest daily, and paid monthly. These rates are certainly one of the highest we have seen in a long time and, best of all, managed in the Chase app. The interest rate is set to rise to 2.1% AER from 24 October 2022.

Zero fees and zero charges

Whether you’re at home or abroad, Chase won’t charge you any fees on your account. If you’re using your card abroad they also don’t charge any markup, commission or transaction fees, Chase uses Mastercard’s exchange rate, so this is competitive and could be something you use when travelling if you are using a traditional bank like Barclays, Lloyds, HSBC these can work out to be very expensive for these types of transactions.

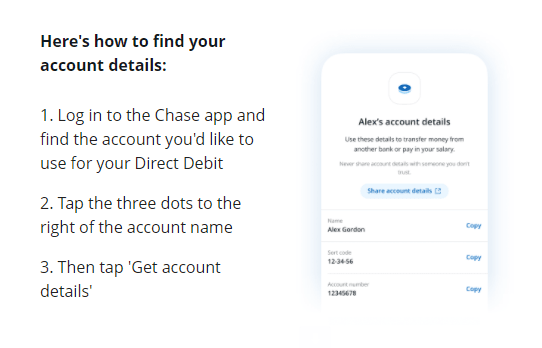

Manage Direct Debit

As of March 2022, setting up and managing direct debits are now supported in the Chase app. This is a really important feature for any current account you are considering as your primary current account. As most of us have many direct debits going out every month, ranging from mobile phone bills to energy bills.

The Chase UK Debit Card

The card is minimalistic, and you won’t find any numbers on the card for improved security. You can still find the numbers of your debit card, but you will need to use their mobile app to get them. So make sure you have enough power on your phone when you’re making online transactions.

They made this card from recycled plastic, and you can really tell the card feels a little on the cheaper side. it’s not a major issue as most pay for almost everything these days on our smart devices with Apple Pay, Google Pay or Samsung Pay.

The Chase UK App

Now let’s talk about mobile app as this can make or break any current account these days. The app is well-designed and works really well. It is responsive, fast and a pleasure to use. Now you might think about how it compares with the leaders in mobile app banking, Startling, Monzo and Barclays, to name a few. Well, to cut straight to the point, it lacks several features. These are overdrafts, 2x or 3x your round ups and connecting to other platforms, e.g. Flux for digital receipts.

How can I sign up?

You can sign up using this link. The sign-up process was simple. Although we had a few attempts at verifying our identity, that’s the ID and the facial scan, which could be improved in our opinion. Once we signed up, it gave us bank account details so we can add funds straight into our account and ordered a card too. There is flexibility in how your name is printed on the card. When the card arrived, they presented it nicely and some style cues taken from Starling bank almost set up like an invitation. Makes you feel more special when receiving the card.

Verdict

Like we have said throughout this review, we really like Chase’s offering. We hope to see Chase continue to offer these cashback incentives and expect to see them improve its feature set and to include overdrafts in the future. However, it is not ready to be your primary current account just yet, but should be suitable as a secondary account if you need one.