Investment strategy requires significant research and consideration, with countless options available to anyone looking to diversify their portfolio. Indeed, investors can construct their portfolios for equity appreciation, passive income, or both. No matter which investment strategy you choose, the best way to invest in stocks is by using a broker. We decided to look into DEGIRO, a company often talked about as one of the lowest-fee online brokerages around. Sometimes, though, low fees mean a more inferior quality of service. Is that the case with this brokerage? Let’s dive in and find out in this DEGIRO review!

DEGIRO Review: The Background

DEGIRO is an online brokerage founded as a wholesale brokerage in Amsterdam in 2008 by five former brokerage employees. Starting in the Netherlands, DEGIRO opened to retail investing in 2013, launched its English language platform in 2015, and now operates in 18 countries across Europe.

DEGIRO aims to use financial technology and expertise to help create personalized financial plans and investment strategies for every user. They offer trading options with below-average fees to help bring entry-level investors into the market.

DEGIRO Accounts

To start our DEGIRO review, we have to look at what they offer potential investors. DEGIRO’s online trading platform is accessible on your computer and through their mobile app. Creating a DEGIRO account comes with zero fees, making it easy to jump onto the platform and see what it has to offer. The platform does require a verification process and can take a couple of days to set up. However, once that’s done, you’re free to dive straight into trading on DEGIRO.

DEGIRO’s available trading markets include:

- Shares

- ETFs

- Currencies

- Leveraged Products

- Bonds

- Options

- Futures

DEGIRO also lists exchange opening hours and stock market holidays for all their available markets to keep investors apprised and ready to plan. There are financial reports for most stocks (which is pretty standard in the industry), and the company provides general market news.

Along with their trading options, DEGIRO has a selection of educational tools that they offer to users to build their knowledge and confidence in investment trading. While they have various learning opportunities, including material on stocks, strategies, and how to trade specifically with DEGIRO, their primary educational tool is the Investor’s Academy. That is a ten lesson breakdown of breaking into the world of investment trading.

DEGIRO Pros

For this DEGIRO review, we’ll walk through the pros of this platform and then some of the drawbacks. As we will see, this online trading platform isn’t quite a slamdunk recommendation.

Fees

One of the main goals of DEGIRO is to make investment trading affordable by offering low fees for both platform use and actual trading. Thankfully, DEGIRO makes good on its efforts and shows below-average fees and commissions across the board.

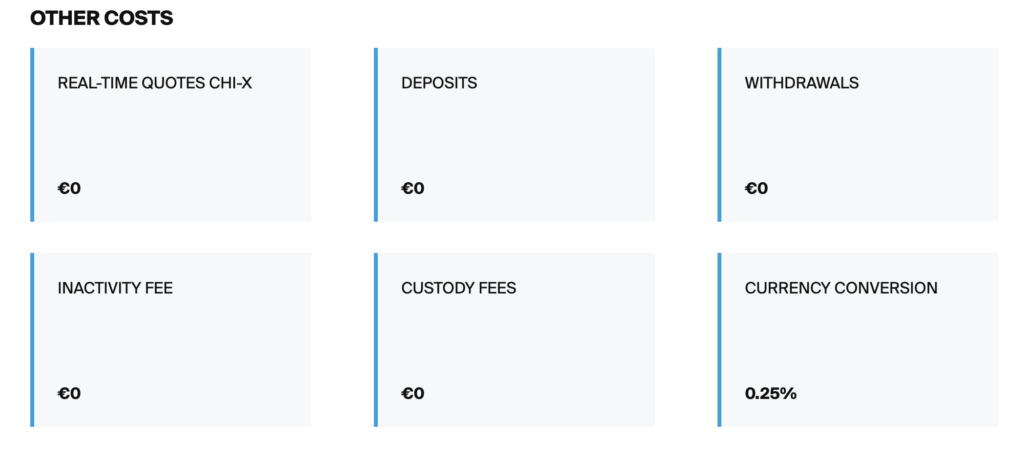

Account setup, as mentioned previously, is free and allows potential users to sign up and start within the 2-3 days it takes for the verification process to run its course. Along with that, DEGIRO also has no inactivity fees, which are incredibly important for people new to investment trading. They may be trying to learn before making moves or lack the confidence to make moves without thorough research and deliberation.

On top of that, DEGIRO takes no fees or commissions for both deposits and withdrawals and has no minimum deposit requirements. The only negative to note about this process is that a DEGIRO account does require you to make your deposit in the currency of your account (i.e., you can’t deposit USD into a GBP account and vice versa).

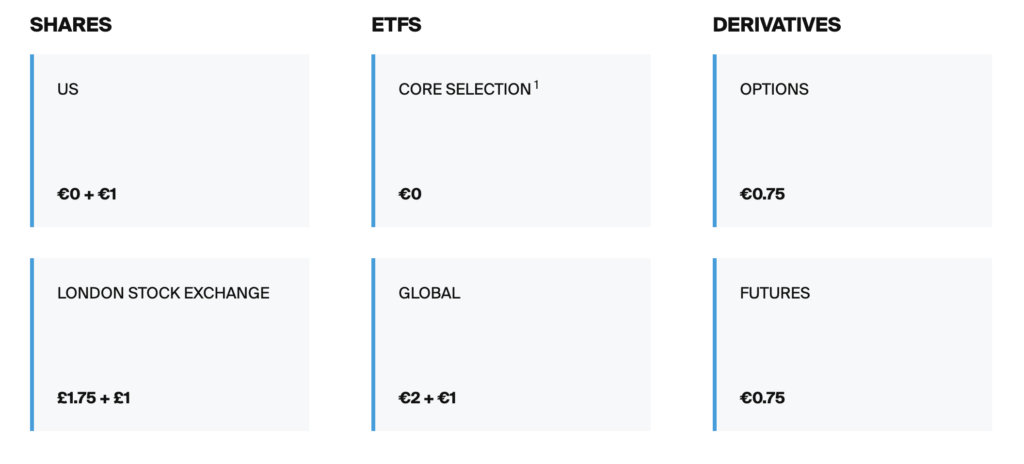

Actual trading fees are pretty low themselves, as they quite succinctly illustrate in their brokerage fee comparison charts. The difference in costs is quite substantial, averaging anywhere from 65% to 98%. With that said, this chart doesn’t include every competitor. However, it does an excellent job of showing just how much users save in transaction fees.

DEGIRO provides a document outlining their listed trading fees on a per trade basis. The London Stock Exchange fees are £1.75 +£1, compared to the US fees, which are €0 + €1*. DEGIRO’s European commissions are €2 + €1. Stocks in Australia, Hong Kong, Japan and Singapore are €2 + €1 per trade. There is no annual custody fee.

DEGIRO’s fees are relatively straightforward throughout their platform, and they are genuinely low-cost!

Educational Tools

DEGIRO’s educational tools are pretty standard, delving into the different branches of investment trading. While the offering doesn’t break the trend in any sense, it’s a welcome feature, and what they do offer is quite helpful.

DEGIRO’s ‘Investor’s Academy’ is the main feature of their educational lineup. While it’s condensed, it still has information that can guide a new trader to understand investment trading basics. The most brilliant move DEGIRO made was to offer both video and text versions of all ten lessons, allowing people to absorb the information in whichever way is more effective for them.

Outside of the ‘Investor’s Academy’, DEGIRO has a stable of informational layouts incorporating large swaths of text with accompanying visual graphs and diagrams to illustrate to readers how things like stocks, bonds, technical analysis, and compound interest. It’s well-formatted and rudimentary in a way that lends itself to the consumer-base DEGIRO targets. Overall, the educational tools are a definite strength of the platform.

Trading Platform Design and Use

The trading platform and the overall aesthetic of DEGIRO’s layout are clean, simple, and easy to use. Accounts are easy to find, read, and interpret, allowing anyone to understand how their investments are doing. Perusing the different market investment options and financial research is also laid out in an easily navigable way.

The platform’s simplicity may not be as engaging and enjoyable for those who are more experienced in investment trading. Still, considering the consumer pool DEGIRO targets, the platform’s easy-to-understand nature is the right thing to do!

DEGIRO Cons

DEGIRO has many things to love about it, but nothing is perfect. While the platform is affordable and navigable, it falls behind in some essential areas because of the low fees.

Research

DEGIRO does have some research materials that are usable and helpful. They provide financial reports and notes on shares and funds, giving users the ability to track past changes and future projections on these assets. Along with that, they pull general investment market and trading news to help keep users up to date on the trends, tips, and significant events of the industry.

Unfortunately, this is where the research assets stop. While DEGIRO has a wide range of trading options, most of them don’t currently have tangible research components that pull together the trends and information of different trade options.

New traders likely won’t find a problem with this. However, as these traders become more and more experienced, the amount of research and data they’ll want will grow. While research material may initially be overwhelming for those just jumping in, it’s a vital part of trading. While it’s impossible to say with 100% certainty why DEGIRO does not include this, it’s likely to save costs because of the low fees.

Simplicity

Listing simplicity as a con may seem counterintuitive, especially given DEGIRO’s target market. However, as traders gain more experience, they will undoubtedly find DEGIRO’s platform limiting.

DEGIRO’s simplicity allows new traders to learn the basics, but it has a ceiling that will eventually become frustrating. There’s a lack of research options and a limitation around the types of trades you can execute. These restrictions will likely drive users to leave for other platforms as they gain more knowledge and want to trade more complex instruments.

Of course, for those who already have significant trading experience, DEGIRO’s simplicity makes the platform a non-starter. If you want to research your stocks, perform in-depth market analysis, and trade more complex instruments, DEGIRO probably doesn’t have the capabilities you want.

DEGIRO Review Summary

As you can tell from this DEGIRO review, the company accomplishes its primary objective: to offer low fees. The platform provides low costs and a simple platform design that makes it widely accessible to experienced and new traders. DEGIRO has enough trading options and educational tools that traders can learn how the markets work at their own pace while focusing on their own financial goals.

However, DEGIRO isn’t for experienced traders looking for in-depth analysis and more advanced trading options. If you have significant experience and want to trade more complex things, you’ll probably want another brokerage altogether.

DEGIRO is good at what it does, but it may be a bit too narrow for some people. There’s a certain charm in that, though. DEGIRO is what it is, and it doesn’t pretend to be more.

Overall, if you’re new to investing and want to pick a brokerage, you may wish to consider one that is offering free stocks as a promotion! We’ve compiled a list of the top four brokerages that give people free stocks as a thank you for signing up. It’s a fantastic way to start investing!

Disclaimer! This post contains affiliate links. Capital At Risk!