The world of finance is fascinating for a variety of reasons. One of the most significant ways this space is unique is that many companies are looking for unique ways to innovate on what is essentially a decades-old concept. Unlike tech, for example, where something like virtual reality wasn’t available 20 years ago, stock trading has been around for over 200 years. Yet, countless companies are looking for ways to innovate and push the boundaries of investing in ways that appeal to more than just the wealthy. Democratizing investing is one of the most remarkable innovations. As we will see in this Freedom24 review, companies like this have done a fantastic job at bringing the concept of investing to those who might not traditionally think of themselves as opening a brokerage account.

Get a Free Stock worth up to $600 when you open an account.

Some are more successful than others, though, and Freedom24 has a compelling offering that is simply different from the rest. Here’s what you need to know about Freedom24, including three different things about this brokerage!

Freedom24 Review: What Is This Brokerage?

Before getting into what makes this brokerage so unique, it’s first worth reviewing some of its history to ensure that it’s a reliable, trustworthy company.

Freedom24 is an offering from Freedom Finance Europe Ltd. This company is the European subsidiary of Freedom Holding Corporation, a publicly-traded company on the NASDAQ under the symbol FRHC. Freedom Holding Corporation operates in multiple countries, including the US, Germany, Cyprus, Russia, Ukraine, Kazakhstan, and Uzbekistan.

The Cypress Securities and Exchange Commission regulates the European division, while the American Securities and Exchange Commission regulates the rest.

Freedom Holding Corporation has been around for a little while now. The company’s date of incorporation was 2008 in Moscow.

Ultimately, this company has been around for a little while, so, unlike some of the new brokerages we’ve looked at on this site, this brokerage should benefit from quite a bit of knowledge and design expertise.

A Unique Sign-Up Process

The first way this brokerage is different from the rest is the sign-up process. Most brokerages are the same – go to the account tab and register for an ISA or whatever type of account you want. You’ll get an account number, and you’ll find some way to transfer some funds from your bank account. That money will wind up in your account either instantly or after a few days.

That’s not the case with Freedom24.

When you get to the site, there are your traditional sign-up and sign-in links where you can create or login to your accounts, respectively. However, there’s also a cart button in the top-right corner.

A cart button?

Yes, as we’ll see in this Freedom24 review, this brokerage wants to reach non-investors with intuitive concepts. How would you buy something off Amazon? You’d add it to a cart. Similarly, you can add the stocks that you want to your cart here.

You’ll then create an account as you complete the “checkout” process.

What’s fascinating about this brokerage is that you can purchase your stocks using a card like Amazon and other online retailers. They accept VISA and MasterCard in the checkout process. However, it is worth noting that they will only accept cards issued by EU banks, and the charges are in Euros. For UK readers, not dealing in pounds presents a little bit of a problem. Still, the conversion process is relatively painless (although your card may charge a currency conversion fee which may mean a bank transfer is the better option for funding your account) unless you are using an FX free debit card like Starling Bank.

Freedom24 Review: They Focus on IPOs

The other way this brokerage feels different from many others is that they strongly focus on IPOs.

Indeed, when you load up the brokerage’s home page, there’s a tab for IPO. When you click on it, you’ll go to a separate page that will give you a list of all the current IPOs. There are typically a few from which you can choose. You’ll have a certain amount of time to apply to participate.

What’s also lovely about Freedom24 is that they focus on the upcoming IPOs, as well. The way they lay out the forthcoming stocks with a grid of cards is well done. You can learn a little more about the company on the card. Additionally, if you click the “More” link, you’ll go to a page with details about the IPO, such as when the date is, the financial indicators, and a bit more about the company.

IPOs are one of the best ways to invest in stocks – especially if you have a strong feeling about the company’s future performance. So having this tab makes it easy to get started being a first investor in the companies you think will do well.

While other brokerages offer the ability to invest in IPOs, none of them provides this service as cleanly and intuitively as Freedom24. It’s self-evident that the business minds behind Freedom24 have given this section a lot of thought. Indeed, they even advertise the ability to invest in IPOs using their mobile app, which shows how important this capability is to them!

Trade Stocks and ETFs on Multiple Markets (Over 40,000 Stocks)

The final way this brokerage is unique is that they permit trading on quite a few markets. Usually, when companies target the retail investing market, they also limit the stocks that customers can trade. There are various reasons for this, but it’s not uncommon for brokerages to permit customers to only trade stocks on the London Exchange or only trade select stocks on the NYSE.

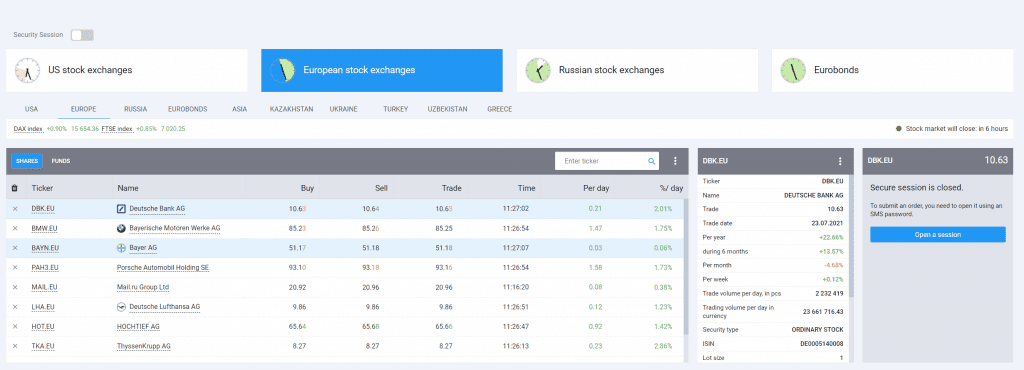

However, Freedom24 allows trading on the NASDAQ, NYSE, Deutsche Börse, London Stock Exchange, Hong Kong Stock Exchange, etc. That means that no matter what part of the world you want to invest in, Freedom24 will probably let you.

Additionally, this means that a wide swath of ETFs are available for you to invest, should you sign up for this brokerage. You can have ETFs from major asset management companies like BlackRock, iShares, and Vanguard.

While some people will elect to buy the most common shares (like Google or Apple), having such a repertoire of potential investment choices is fantastic. As you learn more about investing (or if you want to take advantage of stock run-ups like AMC or GameStop), having this selection is so incredibly important.

Freedom24 Review: What Does It Cost?

As we’ve established, there are a significant number of benefits for people looking to use Freedom24. Indeed, the stock choices, focus on IPOs, great app, and innovative processes are fundamental reasons people should look at this brokerage. However, if it costs a fortune to trade using Freedom24, all these fancy plusses might not be worth it for the average investor.

Fortunately, Freedom24 is a relatively inexpensive brokerage, although how much you’ll pay depends mainly on the frequency and quantity that you trade. Unlike some other brokerages, Freedom24 works on a per-share commission model.

You’ll pay a commission of €0.02 per share you trade for the free plan, with a minimum per order of €2. To receive an SMS notification of the trade costs €0.05.

If you upgrade to the €10 a month plan, you’ll only pay €0.012 per share with a minimum order of €1.20. SMS notifications then cost €0.03.

Finally, they offer a mega plan for €200 a month with €0.008 commission per share and a minimum of €1.20 per order. SMS notifications are then free.

Most people probably don’t trade enough to make the €200 per month plan worthwhile. So, the decision then becomes the €10 a month plan vs the free one.

The Problems with the Pricing Model

The problem with a per-share model is that it doesn’t consider the price of the share. If you buy €1,000 worth of a €1 stock, that’s 1,000 shares. That trade alone would be €20 under the free plan and only €12 under the paid one. However, if you’re planning on buying Google, for example, one share of that company is around €2,000, so you’ll likely be paying a bare minimum in commission no matter what plan you choose.

And then, of course, if you want to invest €10,000 and buy 10,000 shares of a €1 stock, the commissions are pretty high. You’ll spend €200 under the free plan and €120 under the paid one.

Bottom line: Think about some of the trades you’re planning on making. If you’re not looking to trade a substantial number of shares, the free plan is probably relatively cost-effective compared with the competitors. If you are planning on buying many shares, you may wish to look at some competitors that charge the same amount per trade, irrespective of how many shares that transaction contains.

Check Out Freedom24!

As we have seen with this Freedom24 review, there’s a lot to like about Freedom24. It has a fantastic interface, robust trading platform, and an excellent app. Assuming the price works for you, this is a brokerage you should consider trying. However, do give some thought to the stocks you want to buy. If you’re going to buy a large number of shares, you might find more cost-effective brokerages elsewhere.

Freedom24 Free Stock Offer

| Freedom24 Promo Link | Click here to sign up |

| Sign-up Bonus | Free stock worth up to $600 |

| Referral Bonus Terms | Must be an EU resident and aged 25+. |

| Last Validated | September 2022 |