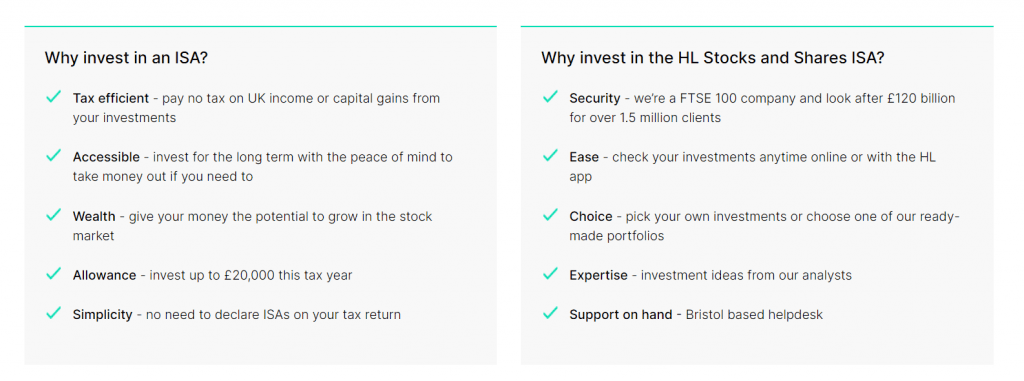

If you’re looking to build wealth, there’s nothing quite like the venerable ISA. The money you contribute to your ISA is free from UK tax and lets you withdraw the money earned whenever you want. And, the limits are not low: you can put up to £20,000 in your ISA every single year. So if you put in that £20,000 and invest in a stock that goes up 10x, you’ll be able to withdraw that £200,000 completely tax-free. That experience doesn’t often happen, of course, but it goes to show the power of investing money into these accounts! You can open an ISA at most share dealers, including Hargreaves Lansdown. In this Hargreaves Lansdown ISA review, we’ll look at what HL offers and how it stacks up against the competition!

Hargreaves Lansdown ISA Review: What Is This ISA?

When choosing an ISA, there are a few factors that you need to consider: account charges, dealing fees, and investment choices.

Account Charges

The most significant factor to consider is the account charge. Most ISAs have an annual fee that is a percentage of the amount you have invested. These fees, although they may sound small, add up significantly.

In Hargreaves Lansdown’s case, the annual fees are somewhat complex and, depending on what you want to invest in, that can either make the HL ISA amazing, or it can mean you can find cheaper options elsewhere.

If you are investing in funds, the account charge table is as follows:

- The first £250,000: 0.45%

- Between £250,000 and £1 million: 0.25%

- Between £1 million and £2 million: 0.1%

- Over £2 million: No charge (0%)

If you buy shares (including UK and overseas shares, ETFs, VCTs, gilts, bonds, and investment trusts), the fee is a flat 0.45%. However, the total amount per year has a cap of £45. So, even if you have £1 million in shares, you’ll still only pay £45!

There are no charges for opening an account, holding cash, or inactivity.

For funds, these fees put it right in the middle for investment accounts of this type. Some places charge more, while other institutions charge less.

To see why this fee is so important, consider the following example. Let’s suppose you put £10,000 annually for 30 years. Those investments earn 5% per year. If the annual fee is 0.5%, you’ll have a balance of £641,641. If you cut those fees down to 0.2%, though, your balance would be £680,338, a whopping £38,698 more just by having a management fee that is 0.3% less! Finally, if you went with an institution with a 1% fee, though, you would only have £582,595, which is £59,045 less than the 0.5% option.

Therefore, if you have an investment portfolio that is £250,000 and you want to buy funds, there are cheaper options. But, if you have a more significant portfolio or wish to purchase shares, HL’s ISA fees are remarkably competitive!

Dealing Fees

Of course, the other way that institutions like Hargreaves Lansdown make money is through dealing charges.

There are no fees for buying or selling funds. If, however, you want to purchase shares, the charge per deal depends on how much activity you had in the previous month:

- 0-9 deals: £11.95

- 10-19 deals: £8.95

- 20+ deals: £5.95

While this pricing is relatively competitive, it’s not as good as some of the other share dealers in the UK. Indeed, it’s not impossible to find ISAs with no dealing fees whatsoever (although those sites tend to charge account fees to make money).

How impactful these dealing fees depend mainly on the amount of money you invest. If you plan on trading thousands of pounds of shares, paying up to £12 per trade is probably not that significant. But, if you’re looking at putting a few hundred in an ISA, that £12 or so per deal adds up fast.

Investment Options

This ISA boasts an impressive 3,000+ investment choices. You won’t have any trouble buying the right stocks and funds for your ISA.

This ISA is famous for its funds offerings and, to that extent, they deliver. There are total return funds, global income funds, and even funds directed at responsible investing. If you’re looking to invest in a specific region, you can do that, too, through the funds offered. While other investment providers have a wide selection of investment choices, none are as competitive as HL.

HL has numerous options to help beginner investors start. Indeed, they have the concept of a “Master Portfolio” and a “Wealth Shortlist.” The Wealth Shortlist is a list of funds chosen by HL analysts for their long-term potential. If you don’t know which funds to pick, choosing one from the HL shortlist would be a good start.

The Master Portfolio helps people begin their investment journey by providing five portfolio styles. The available portfolio choices are: adventurous, medium risk, conservative, investing for children, and investing for income. Once you select a portfolio, you’ll see a mix of funds experts have picked from that Wealth Shortlist to meet your goals.

And, of course, you can buy shares as well, including those overseas. The combination of funds, ETFs, shares, and more mean that investors should have no trouble building a quality, diversified portfolio!

Hargreaves Lansdown ISA Review: Four Products

Hargreaves Lansdown offers four ISA products, each having the same investment choices, fees, and features as above, just for different situations.

The Stocks and Shares ISA is the simplest one. As long as you are over 18 and a UK resident for tax purposes, you can open a Stocks and Shares ISA to shelter up to £20,000 annually from UK taxes. If it makes sense to do so, opening a Stocks and Shares ISA is arguably one of the best investment decisions you can make at any age.

HL also offers three other products that may be better suited for your particular financial situation.

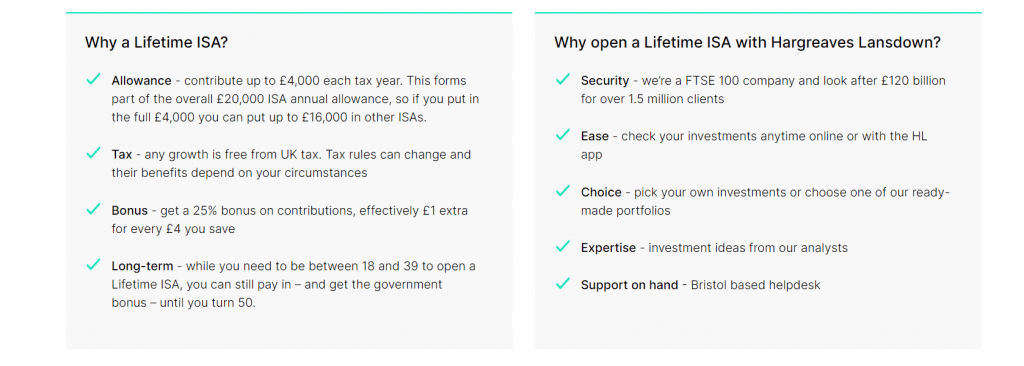

Lifetime ISA

The Lifetime ISA is a potent saving tool for those able to take advantage of it. You can get a 25% boost to your savings from the UK government, up to £1,000 per year. That means you can put as much as £4,000 per year into it (£4,000 of your own money + £1,000 from the government = £5,000 annually).

You must be between 18-39 to open one of these accounts. You’ll get the bonus up until the age of 50. As long as you are 39 or younger, even if you don’t have anything to contribute right away, you should open one of these accounts for the minimum investment possible! That way, you’ll have the account for when you have more money to contribute later in your career. Getting up to £1,000 in free cash is quite significant!

Another use of Lifetime ISAs is to help young people save for their deposits to buy their first home, find out more here about LISAs.

The only downside is that you cannot access your money before age 60 without incurring a penalty. However, you can avoid this if you are using the funds to buy your first home, which is under £450,000.

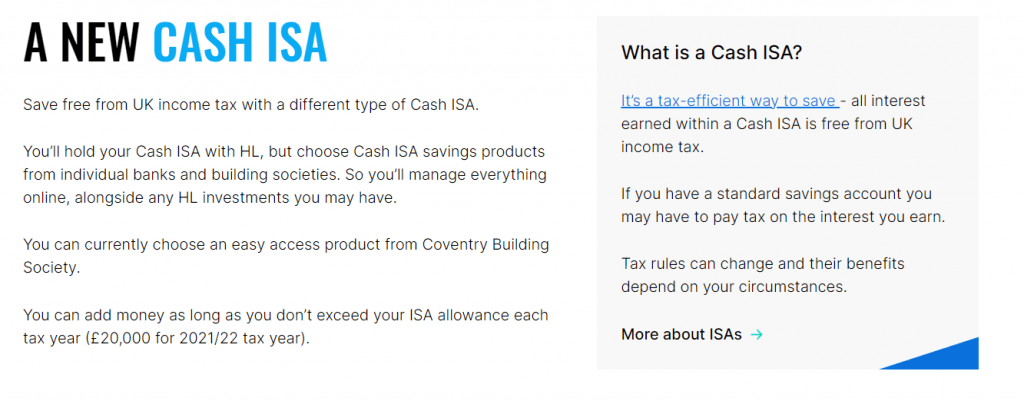

Cash ISA

If you’re looking to hold cash in your ISA, the Cash ISA is arguably the best way to do that. This product is new from HL, and it lets you pick and mix different savings products from various banks and other building societies. The advantage for you, the customer, is that you don’t have to keep filling out forms!

You can then pick different products, like easy access ones or term deposits. The funds are in that particular financial institution, which receives FSCS production up to £85,000. If you have quite a bit of money in your ISA (after many years), this becomes an excellent way to spread out risk without having to manage multiple accounts!

Additionally, funds that go through the Cash ISA have better interest rates than what you can get elsewhere. It is a one-stop-shop for saving money – without putting into equities, funds, or other investments.

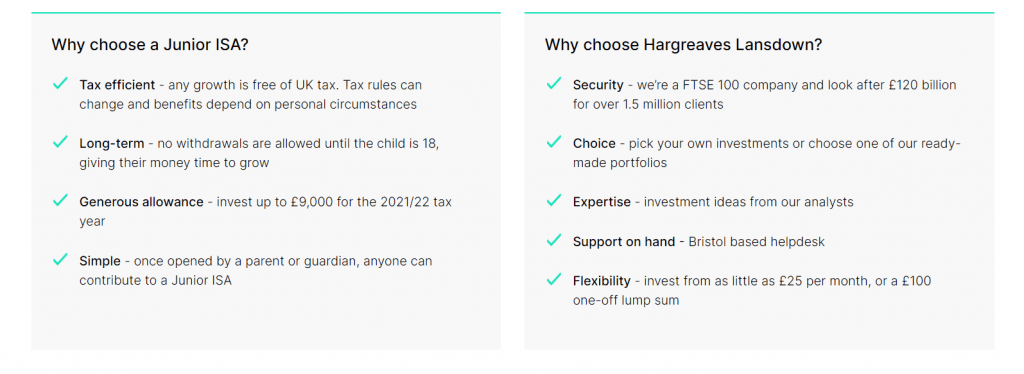

Junior ISA

Lastly, people can open a Junior ISA with HL. A Junior ISA is a tax-efficient investment option for children under 18 years of age. Parents can put up to £9,000 per year into the Junior ISA, which is investable in shares, funds, and has all the same charges and fees noted above.

When your child turns 18, they will gain access to this money. They can use it for university fees, their first home, or even just give them a solid financial footing to start their life outside of your home.

Opening a Junior ISA is an excellent idea if you have children. It is arguably the best way to save for your child’s future!

Hargreaves Lansdown ISA Review: Should You Choose HL?

As one of the U.K.’s most prominent financial firms, it should come as no surprise that the HL offering is overall quite good. You’ll have access to plenty of tools, tips, resources, and financial products that will help you build a solid, diversified portfolio. There are numerous funds and shares to choose from, and you can pick the ISA that best suits your needs.

The only downside is that all this choice is not free. 0.45% for £250k and below is not the cheapest account fee, and £11.95 per deal is not the most affordable fee either. For most investors, it comes down to how much they’re going to be putting in. If you’re planning on investing £20,000 per year, the choice is probably worth those fees. However, if you’re only putting in a few hundred quid, you’ll probably pay far more in fees than you would with other platforms.

Therefore, if you want a top-of-the-line offering that will turbocharge your savings potential, HL delivers. If you’re just starting investing and not sure how much you will do, you may wish to consider one of the more simple, straightforward alternatives.

You can also find more information about HL’s ISA offering and which one is right for you by downloading their ISA guide, check out their ISA calculator or you can use one of the links below to open your ISA today.