There are only a few times in the investing world when something happens that radically changes the way people think about their money, shares, and other assets. Indeed, the introduction of online investing was one of those times, as people no longer had to call a human to place trades. Online investing also brought significantly lower commissions and a much faster, streamlined experience for investors of all calibres. It would not be a stretch to say that Lightyear is revolutionizing investing in the UK. Not to the extent that online investing did, certainly, but in a way that reduces or eliminates many of the fees that UK investors are accustomed to paying. As you’ll see in this Lightyear review, this company is changing the game of what UK investors should expect from their brokerage in a profoundly positive way!

Lightyear Review: What Is This Platform?

Lightyear first started onboarding customers from the UK in 2021, around the same time as it completed an additional round of funding. Founded by investment gurus and Wise alumni Martin Sokk and Mihkel Aamer, Lightyear aims to bring a “global mindset” to the UK investing landscape.

What does a “global mindset” mean, exactly? To Lightyear, this effectively means lowering the cost of investing. Some brokers offer commission-free trading in select markets, like the US and Canada. Many other countries don’t have annual fees based on total account value. These are just two examples where, unfortunately, UK investors have it a little bit harder than some other jurisdictions.

Lightyear aims to change all that. This company aims to reduce fees and lower a given investment’s overall “TCO” (total cost of ownership). Instead of needing to pay £5 per trade, 0.45% of your account’s value every year, and the interbank rate + 1.5% for currency exchanges because you wanted to buy a stock on the NYSE or NASDAQ, what if you could invest with many of those fees eliminated? What if how much it would cost you to own shares and ETFs was much easier to calculate (and much cheaper)?

That’s Lightyear’s ambition – and they’re pretty successful for the most part. Hopefully, their success will encourage other investment firms to lower their fees!

Get $10

Sign up and fund your account to receive $10 credit.

(When you invest, your capital is at risk.)

What Are the Fees for Lightyear?

Since one of Lightyear’s main selling points is its low-cost trading platform, the first place to start is, of course, to see what those fees are and compare them to some other investment firms.

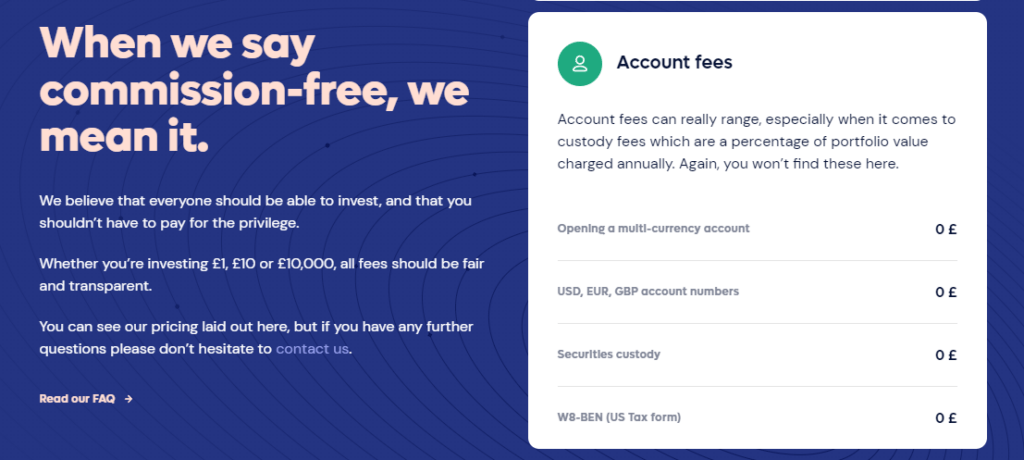

First, securities trading, including buying fractional shares, is entirely commission-free. That’s right – if you want to buy or sell shares, you can do so without paying anything!

Second, there are no account fees! Although the standard for other markets, this is somewhat unusual for UK-based brokerages. Whether you have £10 or £1 million in your account, you’ll pay 0% annually to keep your money and stocks there!

Lastly, many UK residents like to invest in foreign equities. Owning a piece of Apple, Google, Microsoft, and other major companies that you know and love requires being able to buy and sell in US dollars. Many investment firms charge a currency conversion fee – usually, this is an extra charge on top of the base exchange rate. You’ll see this as something like the FX rate + 1.5%.

Lightyear has no currency conversion fees up to the first £3,000 per month you convert. However, if you convert more than £3,000 per month, you’ll pay 0.35% above the live interbank rate. That’s the only actual fee that Lightyear has!

Lightyear delivers on its promise to be as cost-efficient as possible for UK traders. Most people would be hard-pressed to find a better deal elsewhere!

How These Low Costs Benefit Traders: An Example

To see how these low costs benefit traders, let’s look at a quick example. Suppose that you have two investors, one using Lightyear and one using Hargreaves Lansdown. They invest £1,000 per year for 20 years in the same shares, buying a new lot of shares at the beginning of the year and selling them at the end of the year. Further, assume that the shares rise 5% per year.

Hargreaves Lansdown charges 0.45% per year to hold the account. Furthermore, they charge £11.95 per trade. For simplicity, let’s leave out the currency exchange aspect (which HL sets a markup for that Lightyear does not).

At the end of 20 years, the Lightyear account would be worth £34,719.25. However, the Hargreaves Lansdown account would only be worth £32,647.37! Put another way, the HL account is only worth 94.03% of what the Lightyear account is worth.

Even though it may not seem like a lot, those little 0.45% yearly fees mean you’ll have at least 6% less money in 20 years – and that only assumes one trade per year and doesn’t account for currency conversion fees!

Saving on fees is essential. Fortunately, this brokerage provides an optimal way to do that!

Lightyear Review: Account Features and Limitations

Lightyear offers some powerful account features that will appeal to seasoned and new investors alike.

Perhaps the most unique feature is that Lightyear allows for multi-currency accounts. You can hold balances in different currencies in the same account, with the supported currencies being GBP, USD, and EUR. That means you won’t have to keep trading between pounds and dollars, for example, every time you want to buy shares from the NYSE and NASDAQ.

As noted earlier in this Lightyear review, you can hold fractional shares in Lightyear. Investing in fractional shares is very useful if you like to invest £100 in stock, for example, instead of buying two shares and having £5.42 remaining that sits in the account.

The ability to buy fractional shares is one of the reasons that Lightyear lets people open up accounts with as little as £1! You can own your first (part of a) stock for as little as £1.

Speaking of the NYSE and NASDAQ, Lightyear offers access to over 3,000 fractional and non-fractional stocks from US markets. They do not offer UK shares or ETFs yet. However, these are in the roadmap, and customers should be able to access more markets and more stocks at some point in the future.

Lightyear also does not offer some of the account types UK residents may want, like ISAs. Again, those are in the roadmap, and you’ll be able to open those up at a future date, but people can only create a standard investment account right now.

A Gorgeous App to Use for Trading

Part of what makes Lightyear so unique is its app. Put simply, it’s useful, gorgeous, and highly intuitive. Lightyear wants to make it easier for investors to make decisions about their investments, and their app goes a long way toward making that happen.

From the moment you open the app to the moment you start trading, it’s evident that the developers behind Lightyear have given a tremendous amount of thought to the overall process. Indeed, when you open the app, you’ll simply need to enter your name and email address. That’s it for the first screen! Of course, to create an account, you’ll need much more information, including your NIN, but seeing something so simple on the first screen helps people feel immediately at ease.

Once you create an account, you can explore stocks within the app. All the animations, graphics, and charts are remarkably fluent. Additionally, you can see almost all useful metrics at a glance for any given stock. For example, you can see the stock’s P/E ratio, market cap, etc. You can see what the analyst sentiment is and price targets. There’s a remarkable amount of information conveyed on an easy-to-read screen.

Bank transfers are also remarkably straightforward from the app. It’s a simple process to connect your bank account, and once you do, you can make pretty much instantaneous transfers to your brokerage account! That’s incredibly useful as it lets investors deposit money if they need to take advantage of a dip!

Finally, the theme is gorgeous on Lightyear. They offer both light and dark modes, and both look stunning. Everything looks sleek and modern, and all the visual elements tie well together. That’s somewhat unusual for a trading app as they often feel like developers took multiple systems and independent components and stitched them together!

All in all, using the Lightyear app is a breeze. If you like to make your trades on your Android or iPhone, you’ll love Lightyear!

Lightyear Review: Trading Has Never Been So Inexpensive!

Lightyear is one of the best options for trading if you are a UK resident that wants to buy US shares. The app is gorgeous, the platform is fast, and the fees are non-existent. It’s hard to describe how liberating not having to pay a fee to buy and sell shares is. There have been other brokerages that have offered this. Still, it’s rare to see one that eliminates the commission and the account fees for any balance. And on top of that, the brokerage still manages to eliminate currency conversion charges up to £3,000 per year. As this Lightyear review shows, it’s a good offering!

That, of course, is why Lightyear is so revolutionary for the UK investing landscape. It challenges investors of all types to expect more from their brokerage and demand fewer fees. Indeed, Lightyear has shown just how successful a brokerage can be without nickel-and-diming on every investment. If you want to pay less to invest your money, check out Lightyear!

Get $10

Sign up and fund your account to receive $10 credit.

(When you invest, your capital is at risk.)