Founded in 2011 by Giovanni Daprá and Paolo Galvani, Moneyfarm has become one of the leading online wealth management and investment advisor companies in Europe. In 2016, they launched in the U.K. market for the first time, and the platform was an instant success. As of now, they have £1.6 billion in assets managed and over 60,000 investors. A lot has changed, though, in the world of finance since 2016, so is Moneyfarm still a great investment choice for U.K. residents? Let’s find out in our Moneyfarm review!

Moneyfarm Review: What Are Robo Advisors?

First, before delving into whether or not Moneyfarm stacks up against the competition, it’s worth understanding what precisely Moneyfarm offers. They are not a share dealing company, and therefore, it does not compete in the same space as big brokerages like Hargreaves Lansdown.

Instead, Moneyfarm belongs to a class of investment companies called “robo advisors.” Traditionally, investment advisors were all humans that would individually review a person’s risk tolerance and investment knowledge to recommend investments that would suit them. These advisors were highly regulated and had to meet stringent requirements.

However, in recent years, investment companies have begun to realise that having a person do this is both error-prone and costly. Plus, people tend to want to start investing – not have some long, drawn-out conversation with an advisor.

So, the concept of the “robo advisor” was born. These companies would have a range of portfolios – some invested conservatively and some aggressively – and ask a series of questions to determine which portfolio best suited your objectives. Of course, all these questions are online, and the advice you’re receiving comes from an automated algorithm and not a human (hence the term “robo”).

Your money is still professionally managed by human experts, though. It’s just the advice and guidance you receive that comes from an automated platform instead of a human reviewing your answers.

Moneyfarm Review: Available Portfolios

Moneyfarm offers seven different portfolios (named “Portfolio 1” through “Portfolio 7”). Portfolio 1 has the lowest risk profile and is effectively just bonds and cash. Portfolio 7 has the highest risk and has no bonds but mainly consists of developed markets equity.

One surprising aspect of Moneyfarm’s portfolios is that they don’t offer portfolios based on particular sectors or social goals. For example, some firms might offer an aggressive portfolio based on tech companies or a conservative one based on environmental responsibility. With that said, Moneyfarm does offer “socially responsible” versions of their portfolios (portfolios one through seven). However, there is no further adjusting than that, so if you want a portfolio that’s pro-environment or pro-green energy, for example, that’s not an option.

Compensating for that is the fact that Moneyfarm portfolios have historically tended to outperform competitors. They calculate their returns and compare them to benchmarks by Asset Risk Consultants. These benchmarks represent averages of similar investments among large asset managers, private banks, and wealth managers. All but one portfolio (the second-lowest risk one) has outperformed what the competition has done over the past five years. That is quite a remarkable achievement!

Therefore, if you want well-designed portfolios, Moneyfarm appears to be the best place to go (remember, though, past performance is no guarantee of future returns). However, if you want more control over your investments, you’ll need to look elsewhere.

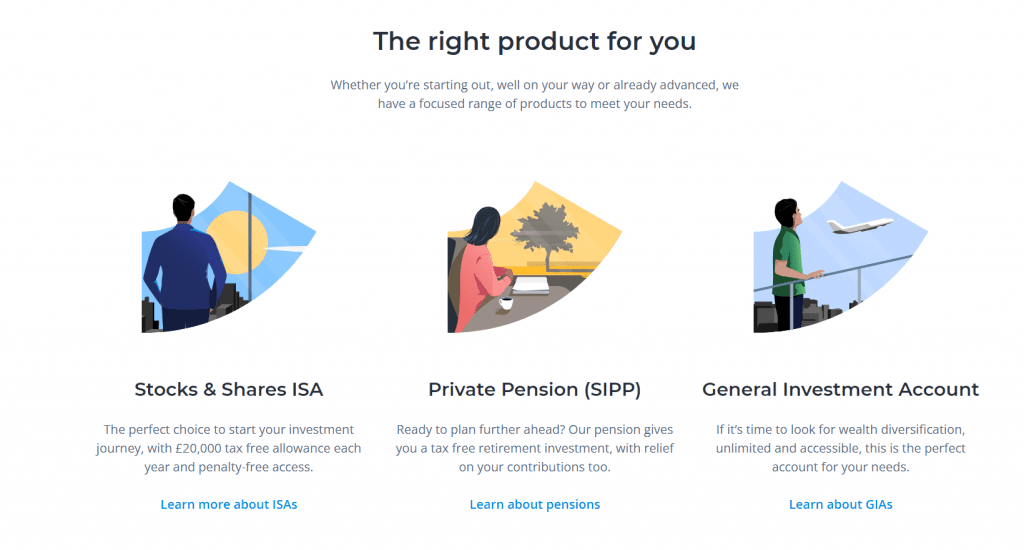

Account Types U.K. Residents Can Open

Another area where Moneyfarm excels is the account types available for U.K. residents to open. You can open a regular Stocks and Shares ISA, a SIPP (pension), and a General Investment Account. Having all three of these available means that U.K. residents can take full advantage of the tax benefits that come with each account type. Residents can open an ISA to invest up to £20,000 per year, 100% tax-free. Residents can also open a SIPP to get a 25% boost to their pension without a claim to HMRC. Finally, once people exhaust those plans, they can open a GIA for additional investment savings.

Ultimately, the number of accounts you can open means that Moneyfarm is a place where U.K. residents can invest as much or as little as they want. There are also some attractive options at play, where you may have your SIPP account be ultra-conservative, your ISA be moderate-risk, and your GIA be the highest-risk. That way, you won’t have as much risk in your retirement funds as you will in your more “discretionary” GIA investments.

Moneyfarm Review: What Are the Benefits of This Robo Advisor?

By now, it should be relatively evident from this Moneyfarm review that there’s a lot to like about this particular platform. On the surface, it seems to have everything going for it: quality algorithmic advice, easy-to-use, and making investing simple and accessible. Indeed, there is a lot to love about Moneyfarm. Here are the three best features of this platform.

Pricing

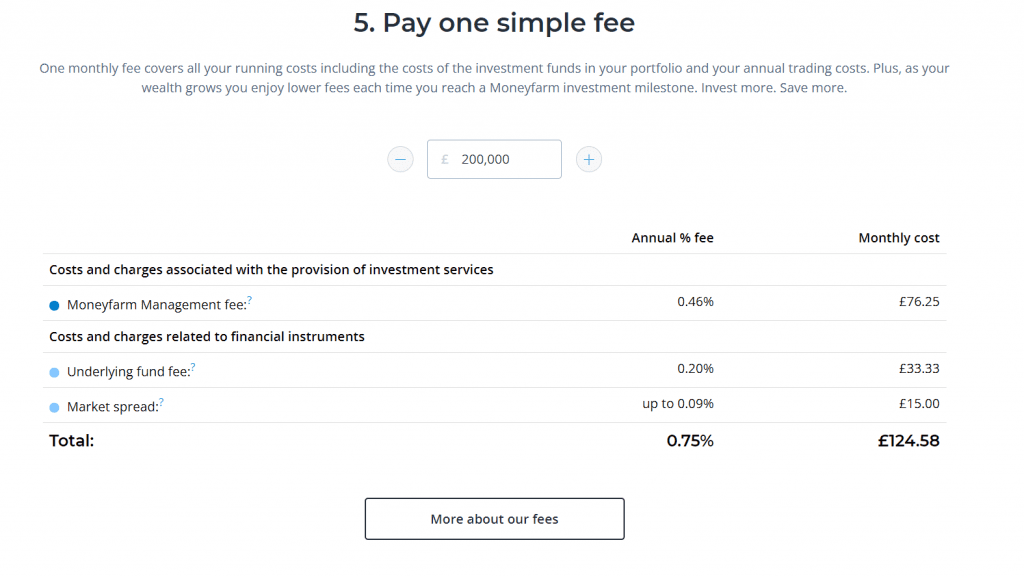

For the service you receive, it’s hard to beat Moneyfarm’s pricing. You’ll set up your portfolio for free and have no subscription or trading fees. You can swap out of one portfolio and into another if you would like!

The way Moneyfarm makes money is by charging a money management fee. One of the most admirable aspects of Moneyfarm is that the more you have invested, the more that cost shrinks. On your first £10,000 in balance, you’ll pay 0.75%. Then, on the next £40,000, you’ll pay 0.60% (balance from £10,000 to £50,000). On the next £50,000, you’ll pay 0.50% (balance from £50,000 to £100,000). Finally, on any balances over £100,000, you’ll pay 0.35%.

There are also underlying fund fees (Moneyfarm’s portfolios consist of ETFs, each with their expenses). These fees are typically around 0.20%. Finally, there’s also a market spread which can act as a cost on your investment when you trade. That market spread is typically around 0.10%.

Here’s how that works in practice. Let’s say you have £200,000 invested. Your monthly cost breakdown is as follows:

- £76.25 Moneyfarm management fee @ 0.4575% effective (0.75% x £10,000 + 0.60% x £40,000 + 0.50% x £50,000 + 0.35% x £100,000)

- £33.33 underlying fund fee

- £16.67 market spread

That comes out to £126.25 per month to have £200,000 expertly managed – complete with proper portfolio rebalancing, regular investment updates, and checks to ensure that the risk level you’ve chosen still matches what you need.

It’s fantastic pricing for high-end investors and equally excellent for lower-end ones. Even if you have £1,000 invested, you’ll wind up paying less than £1 per month for an expertly managed account! Beating that pricing will be hard for any competitor!

The App

The Moneyfarm app has a 4.7 rating on the Google Play Store and a 4.7 rating on the Apple Store as of this writing. There’s a reason for the high ratings – it works and works well.

Indeed, the Moneyfarm app is a joy to use. It will walk you through setting up an investor profile, showing you the composition of your prospective portfolio, and showing you account balances, including all your SIPP, ISA, and GIA balances. It even has a section for the latest market insights. This app is a one-stop destination where you can catch a glimpse of your financial future in one brilliantly easy-to-use interface.

The app itself is free from bugs, and most reviewers note what a joy it is to use. Unlike some investing apps, which are clunky and difficult to use, Moneyfarm makes it easy for anyone – young and old, novice or experienced – to invest using their app!

They Have Superb Documentation and Support

Another area where Moneyfarm excels is their documentation and support. On their site, you’ll find investing ebooks, guides, an FAQ, and a glossary. If you’re having trouble creating an account or trading, there’s a customer service number you can call to get assistance. There are two numbers, one for local calls and one for calls abroad, so no matter where you are in the world, Moneyfarm is available to support you!

Moneyfarm Review: What Are Some Drawbacks?

While there’s a lot to love about Moneyfarm, there are some drawbacks. Here are two that prospective clients should understand before investing in this platform.

Limited Investment Choices

This review already touched upon this downside, so there’s no point in rehashing it too much. There are seven different portfolios from which you can choose, as well as their socially responsible counterparts. That’s not a lot of investment choice. If you want to pick individual stocks, individual ETFs, or like to have a few different investment choices available to you, this is not the platform for you. Moneyfarm’s target market wants a one-tap investment solution, and on that front, it delivers!

High Starting Amounts

To get started, you’ll need at least £500 as that’s the minimum required to open an account. However, Moneyfarm recommends at least £2,500 to provide them with more opportunities to diversify and get as close to your risk profile as possible.

Therefore, unless you’re looking to invest £500 or more (and, even if you start that low, you should be looking at increasing it shortly), Moneyfarm is not a viable option. You may want to look at alternatives like InvestEngine which we have also reviewed.

Moneyfarm Review: There’s a Lot to Like About This Platform

With low investment fees, solid portfolios, and an easy-to-use app and website, there’s a lot to love about Moneyfarm. It’s a wonderful choice for anyone looking for a straightforward, intuitive investment platform. Those with more experience may want something with a little more choice and control. However, the simplicity and low cost mean that even seasoned investors should consider Moneyfarm – especially for some of their more critical assets (like retirement funds).

All in all, Moneyfarm is easy to recommend whether you have £2,000 or £200,000 to invest!